Investmentz mobile¶

Portfolio¶

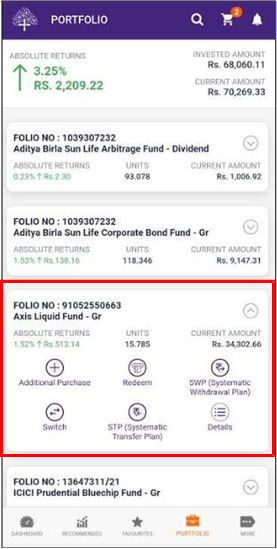

You can check the invested funds and their absolute returns on this Portfolio page. Click on the fund ,click on the drop down if you wish to make additional investments or redeem a fund, You can also make Switch, Systematic withdrawal plan (SWP) & Systematic transfer plan (STP).

By clicking on details you can see details of the fund w.r.t total amount invested, No. of units, NAV etc.

Through Portfolio page, you can make different types of Transactions which is shown below.

Additional Purchase¶

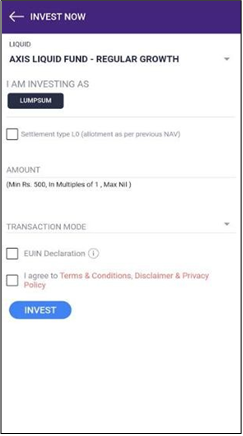

Lumpsum

It is one time investment you can do in any scheme. Unlike SIP, you can make multiple Lumpsum payments at any point of time.

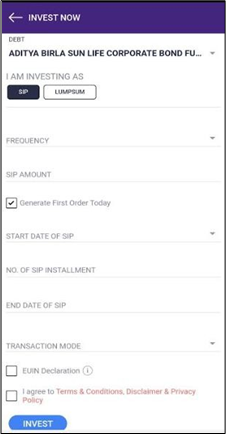

SIP (Systematic Investment Plan)

A Systematic Investment Plan (SIP), is a way of investing money in mutual funds, where one invests a fixed amount of money, automatically at periodic intervals. The amount of investment can start with as low as Rs. 100 (depending upon the scheme) and one can choose different frequencies varying from – Daily, Weekly, Monthly or Quarterly.

Redemption & Systematic withdrawal plan (SWP)¶

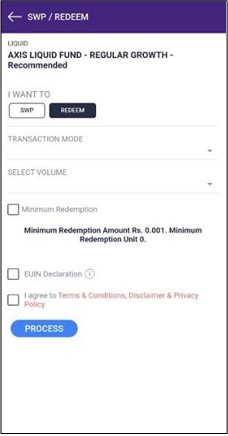

Redemption

Amount is redeemed at the fund's net asset value (NAV) for the day. Once the transaction is completed, clients receive their funds including any returns via direct deposit to their bank account.

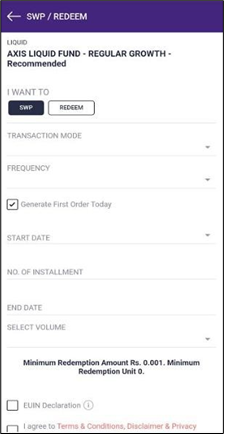

Systematic Withdrawal Plan (SWP)

Systematic Withdrawal Plan allows you to withdraw a fixed amount from your mutual fund scheme on a preset date every month, quarterly, semiannually or annually as per your needs.

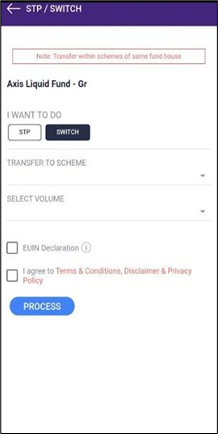

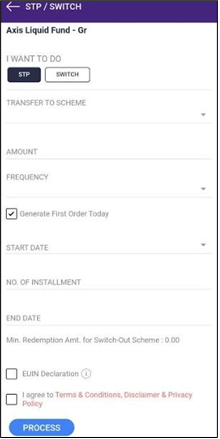

Switch & Systematic transfer plan (STP)¶

Switch

Switch refers to the process of transferring investments from one scheme to other. It is shifting a portion of or the entire investment from one scheme to another.

Systematic Transfer Plan (STP)

In Systematic Transfer Plan (STP) method of investing an investor transfers a fixed amount of money from one category of fund to another in a fixed interval.

For example: You can shift from a debt fund to an equity fund.