RESEARCH SERVICES

- WHY RESEARCH ADVISORY?

- RESEARCH METHODOLOGY

- RESEARCH PUBLICATIONS / ALERTS

- SPECIAL RESEARCH REPORTS

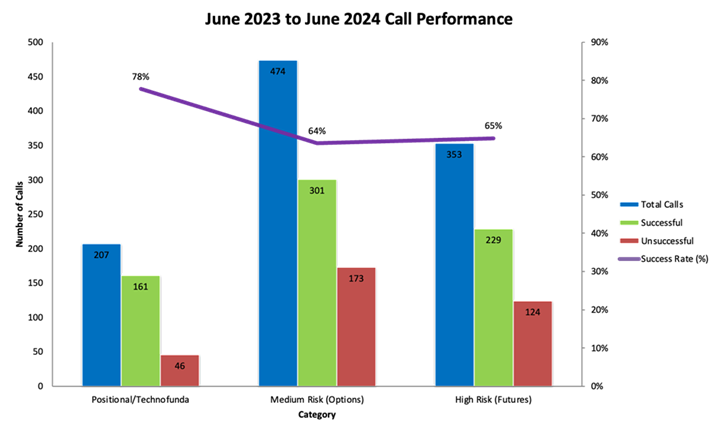

- OUR RESEARCH PERFORMANCE

WHY RESEARCH ADVISORY?

Investing in equities is confusing. One wants to be part of the stock markets, but the sheer information overload is daunting. We at Asit C. Mehta Investment Interrmediates Ltd. (ACMIIL) want to address this need of making an informed decision while investing in stock markets. The returns and risks associated with each investment need to be understood. Investment decision should be made based on the risk appetite of each individual. Our research calls are supported by extensive research from our expert team tailored to the risk appetite of each investor.

RESEARCH METHODOLOGY

Our Research methodology involves fundamental as well as technical research. We have highly skilled staff equipped in analysing various parameters that affect performance of indices , industries and companies. Various predictive tools are used by us in this process to study price trends . Meeting with company managements is also done. Detailed process is described below.

FUNDAMENTAL RESEARCH

We identify opportunities to generate investment ideas in the equities segment. The process involves:

- Researching macro-economic and micro-economic conditions along with company fundamentals.

- Collecting and analyzing financial information to make specific investment recommendations.

- Interacting with the company's management to identify key rationales that drive performance.

- Building financial models to evaluate company’s intrinsic value.

- By studying industry outlook and respective company we recommend Investment Ideas

TECHNICAL RESEARCH

Our technical team identifies opportunities for short- term profit in equities and equity derivatives.

- Tracking price charts of scrips and indices.

- Judging impending trends by using predictive analysis.

- Incorporating indicators such as EMAs, ADX, RSI, and oscillators into the recommendation decision.

- Using derivatives data such as open interest, put-call ratios, and volatility into the recommendation decision.

- Ensuring risk mitigation through strategies such as hedging, covered calls, and protective puts into the recommendation decision.

- Stocks selection only from NSE500 and loss-making companies are avoided.

- Using high end real time charting and tracking applications to update views in a dynamic environment

- Ensuring that calls are given only on companies that have no corporate governance issues and companies’ earnings is positive.

- Low floating stocks are avoided during first screening and many other parameters are taken while screening the stocks.

- Issuing regular updates and advising clients on when to book ideas.

- Based on various chart pattern, technical indicator, F&O activity like OI, PCR, VOL, ROLLOVER etc we recommend Technicals, futures and options call

RESEARCH PUBLICATIONS / ALERTS

Market Pulse (Monthly)

Market Pulse, a monthly report of ACMIIL, aims at providing investors with insightful perspectives on essential aspects of the market. This includes fundamentals, technical, and derivatives. The report focuses on updates from domestic and global markets, equity reports of companies, technical reports of indices, etc. The objective is to capture the market in all its hues and colours, and to provide a wide range of information that helps in making wise investment decisions.

Market Watch (Daily)

It includes Pivot table of Futures, Cash and Midcap stocks which is helpful for Intraday traders. Along with that it also provide Research Call Tracker which help to keep track of Research Performance.

Morning Notes (Daily)

It is our daily morning update to all ACMIIL clients and BAs, Report includes major Domestic and global indices movement, Key F&O highlights and major corporate news.

Investment Idea

ACMIIL Investment Ideas is for Medium to Long-term Investors. The company is being recommended after doing a detailed Fundamental Analysis. The objective is to earn returns by investing in good companies with value and growth opportunities.

Derivatives Rollover Analysis (Monthly)

Monthly report on Rollover analysis of Index & stocks Futures.Stocks Recommendation for Next month along with Index View

Weekly Technical Synopsis (Weekly)

The Weekly Technical Synopsis Report aims to provide insightful Perspectives to traders with a weekly technical setup for key indices and stock-specific technical views.

Weekly Derivatives Synopsis (Weekly)

Report on Derivatives for Index & stocks Futures. Stocks Recommendation for Next Week along with Index View

Derivatives Rollover Snapshot (Monthly)

Monthly report on Rollover before expiry day (D-3 to D-1) of Index & stock Futures.

Techno Funda

Stocks looking strong on fundamentals and the technical chart with a time frame of up to 12-15 weeks, with a well-defined target and stop loss

SPECIAL RESEARCH REPORTS

RBI Monetary Policy (As per RBI Meeting)

Update on RBI Monetary Policy Committee meeting on Interest rate, GDP, Inflation and overall outlook. We accordingly analyze and conclude the same.

Union Budget Report (Yearly)

The report contains major announcements in Union Budget, along with likely impact on sectors and companies.

IPO ANALYSIS REPORT (As per IPO Announcement)

We proactively study the upcoming IPO and after doing analyst meet i.e. interaction with management. We recommends the issue as Subscribe or Avoid

Our Research Performance