Portfolio Management Services in India

Markets are complex and extremely volatile. Not every investor is equipped or has time or is willing to manage their equity exposure on their own. You need a surgeon’s skill to discard the bad and revitalise the good. A PMS fund manager performs that role for a customer’s portfolio. It is best to leave it to experts to manage the funds.

Portfolio Management Services offered by ACMIIL is managed by the professional fund managers by customizing your portfolio according to your financial goals.

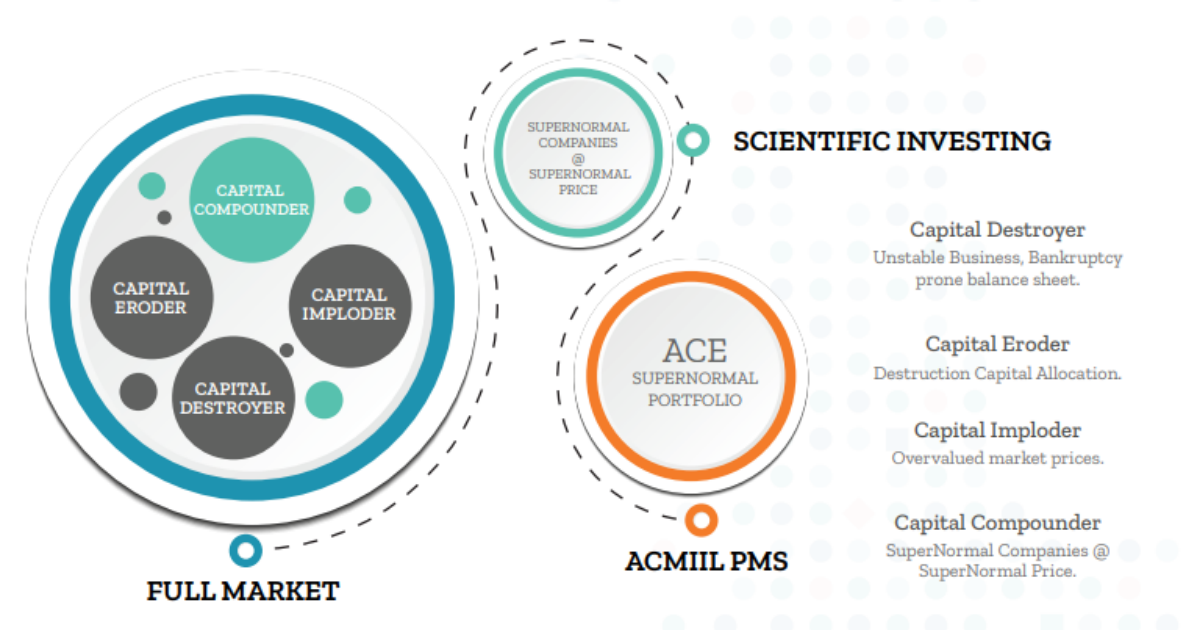

OUR Investment Philosophy

At ACMIIL, we combine the scientific approach of investing with the principles of value investing preached by world-renowned investors like Benjamin Graham and Warren Buffet to provide you one of the best portfolio and wealth management services in India.

While the scientific approach enables us to be consistent in managing portfolio risk, the principles of value investing enables us to find stocks that are currently undervalued and have the potential to generate wealth of you. We simply do not buy stocks, we help people buy valuable businesses. Our goal here is to provide fundamental value to you as an investor who trusts us with their time and funds.

Stock Selection Methodology

Super Normal Companies & Super Normal Price

For further details on our PMS product features, factsheets, etc, please www.acmiilpms.com

Guidelines for Investing in PMS

There are certain guidelines to follow to invest in PMS. It is important to adhere to it as an investor while looking for the best portfolio management companies:

- We suggest a 3-year horizon for all your investments, because we believe in long term investing. We do not frequently churn your portfolio.

- We review the portfolio on daily basis, but we suggest removal and addition of scrip’s only when there is a major change in the company’s outlook. This is generally once a year.

- Based on your risk profile you may select the various strategy that we presently have ie. ACE-Multicap, ACE-Income, ACE-Allocator, ACE-Midcap, ACE-50 & ACE-15.

- We provide PMS services only on Discretionary basis. That means we will select the companies for in investment on your behalf, you may opt for the strategy based on your risk appetite but the final selection of company will be done by our research department. Entry and exits from the company are governed by the terms of agreement between you and sour company.

- Please note past performance does not guarantee future performance.

- Stock market investments are subject to market price fluctuation risk.

- We have appointed Orbis Financial---as our custodian for funds and shares which lie in your PMS. You will have to open a bank account (For ACE-Income scheme only) and a Depository account with them

- Broking account can be opened with our company or you can appoint any broker for executing the PMS trades or use your existing broker. In case you use any other broker, we will have to develop online communication links to place your orders.

- Dividends will be directly credited to your bank account with custodians.

- We have designated a customer service manager who will explain the Portfolio performance on quarterly basis.

- Minimum funds to be invested as required by SEBI is Rs. 50 lakhs.

Fees Structure

We have 2 fee options available. Clients can opt for any 1 of the following 2 models:

- Fixed Fee Model –Charged as a % of AUM on a daily NAV basis and deducted quarterly.

- Performance Fee Model – A smaller portion of the fee is charged (similar to the Fixed Fee Model). Another portion is charged as a % of returns in excess of the hurdle rate (at present 10%), payable quarterly based on the profits on pro-rata basis. Charged on Notional Profit with high watermark applicable

Regulatory Oversight

- Securities and Exchange Board of India has prescribed specific regulations for monitoring the performance of a Portfolio Manager.

- A company desirous of providing PMS service must be registered with SEBI.

- There is a minimum net worth of Rs 2 crores, for the Portfolio Manager who have registered before 16th January, 2020. Portfolio Manager cannot guarantee any minimum returns to the custome.

- Minimum amount that can be invested in PMS strategy is Rs. 50 lakhs.

- Half Yearly returns & AUM certified by auditors are filed with SEBI.

- The Disclosure document that is signed with the customer is also filed with SEBI.

- SEBI does not guarantee safety of money of the customers, all it does is prescribe guidelines to ensure that the fund manager works within a tight set of rules.

- SEBI issues guidelines from time to time strengthening the regulatory framework of relationship between the Portfolio Manager and his customers.

Taxation And PMS

Tax for the PMS investment is to be paid as per applicable laws As per current laws Dividends are subject to tax. You may consult your financial consultant/tax consultant for filing of Income tax returns.

Agreement for PMS

Our Portfolio Management Service agreement copy can be downloaded on request. Please fill you contact details or email us at pms@acm.co.in or call us at: 22 2858 3759

Franchisee

We appoint Distributors for marketing our Portfolio Management Services. Please send your inquiry on Franchisee Inquiry Form.

Disclosure & Download Brochure

Disclaimer

Investment in securities market are subject to market risk, read all the related documents carefully before investing. Investors are required to carefully consider their investment objectives, risk appetite, risks involved, and the charges and expenses involved, before investing.

Past performance is not indicative of future performance and future results. It is not possible to invest directly in an index. ACMIIL does not sponsor, endorse, sell or promote any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. However, the recommendations made by ACMIIL could be those that are based on its own research. Any performance/returns presented here or separately are based on Time-weighted rate of return on an Aggregate portfolio for strategy evaluation. Performance related information provided is not verified by SEBI. Portfolio performances are post-expenses. Individual returns of Clients for a particular portfolio may vary significantly from the performance of the other portfolios. No claims may be. made or entertained for any variances between the performance depictions and individual portfolio performance.

For more info please visit Disclaimer