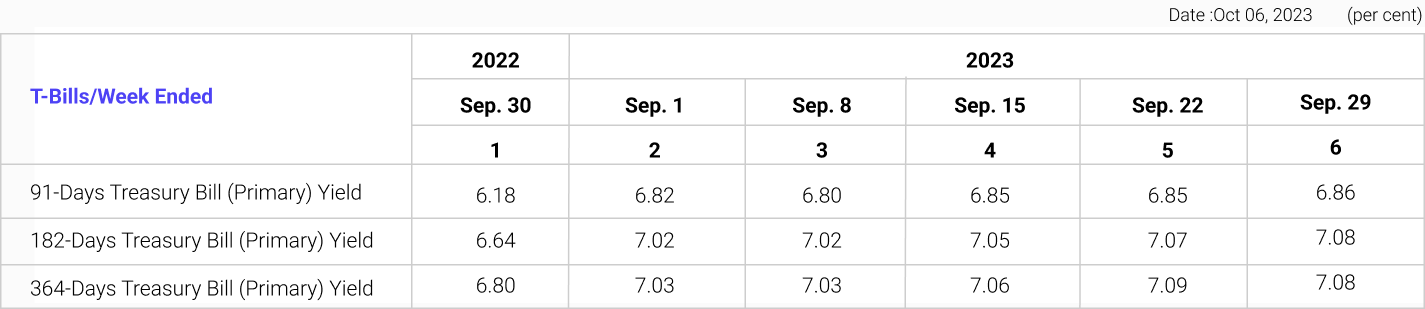

T-Bills FAQs

T-Bills being the short-term investment instruments help the Government of India to raise the funds to meet the brief development projects such as building highways, hospitals, etc. This instrument generates substantial/ excess revenue annually. The goal to issue treasury bills to the investors is to reduce the fiscal deficit in the Indian economy and to regulate the liquidity during a given time. RBI issues the T-bill.

T-bills are considered one of the secured forms of investment in our country. This instrument is ideal for investors who have surplus funds and want to invest in the safe tool to enjoy substantial returns. Basically to invest in T-bills is for those individuals who like to maintain the fund holding into the government investment tools to minimize the risk on their total capitals. Also, it is favoured for portfolio diversification.

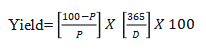

T- Bill Yield calculation:

The Treasury bill is calculated based on the following formula:

Where,

P= purchase price

D= days of maturity

No. of days for T-bill= [Actual number of maturity days/365]

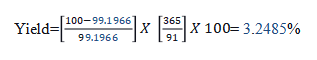

Suppose- the 91 day T-bill is issued at the price of ₹99.1966, so the yield will be based on the above-given formula:

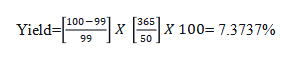

When the same issued T-bill is trading at the price of ₹99 after 41 days, the yield percentage will be:

Please note: the maturity days remaining for T-bill is 50 days.

T-bills are issued twice in a week- every Monday and Tuesday. The investor should have Demat Compulsory. The minimum application of Rs.10000/- and maximum of Rs. 20000/- .

You can apply through our web portal in Treasury bill section

Treasury Bills are 100% guaranteed by Government of India for return of Principal.