Investment Basket FAQs

An investor cannot sell individual stocks from the basket. An investor can exit from the entire stock basket/s anytime but they are not allowed to exit from the selected stock/s from the basket. To remain invested in the stock basket and to ensure more efficient management and differentiation of stocks in which the investor has invested on his own and the investment that he has made in the stock basket, the investor needs to open a separate Demat account for the stock basket investment.

No. However the shares are selected based on long term duration i.e. at least 3 years. So it is advisable to stay invested for a period of 3-5 years

No charges will be applicable on another Demat account. Investor- new and existing ones can operate 2 Demat accounts- one account to manage their investments and another to manage stock basket investment.

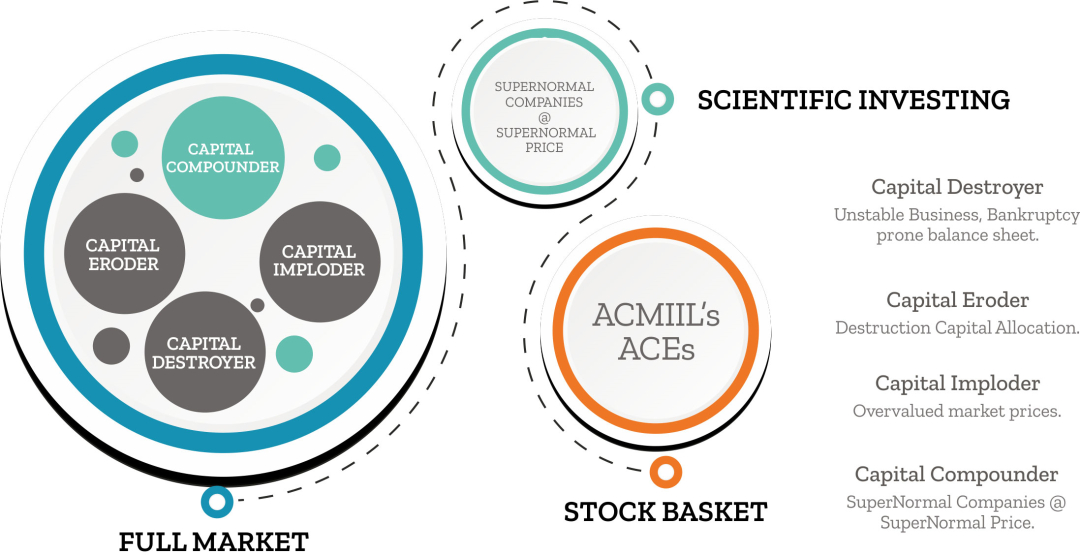

The stocks in the basket will be as per the discretion of the ACMIIL. Our team of equity experts would review these stocks from time to time. If one stock is not performing well, our team may replace it with a stock which in our team’s view is one of the best performing securities in the market. This again will be at the discretion of ACMIIL. But the investor has the option to create a basket of his own.

In a bank mandate, a third party will be authorized to debit a specific sum from your bank account during regular intervals. By submitting a mandate form, you authorize your bank to conduct an auto-debit transaction. In this transaction, the specified amount is drawn from your savings account on predetermined dates. The drawn amount is then invested by way of SIPs in the stock basket you want to invest in. This will be the case if the investor chooses the SIP way to invest in the stock basket. Hence, bank mandates facilitate investments in the most hassle-free, paperless, and convenient manner. Concerning the bank mandate, we will need 20% more mandate for the entire basket amount. This is because of the fluctuations in the stock price. Please note it is compulsory to have a bank mandate for Stock Basket investment

Stock Basket Systematic Investment Plan (SIP) is a method of investing in any basket, wherein an investor invests a fixed amount of his choice at regular intervals. It is advisable to start an SIP so that there is regular saving habit and you can also average the price by buying during different points of time in the market.

Stocks are not frequently replaced, but they are frequently monitored. Stocks are replaced if a company is not performing on anticipated growth plan expected during the time of investment.

Yes. As the shares purchased using the Stock Basket App will be in your DEMAT account, you will receive all the dividends directly in your linked bank account.

Other corporate actions such as Bonuses, Splits will also be adjusted automatically in your DEMAT account. The Basket profits or returns would include any dividends, benefits received out of corporate actions.